Windfall elimination calculator

Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement benefits for workers who also collect a non-covered pension from a job in which they didnt pay Social Security taxesThe provision affects about 19 million Social Security beneficiaries most. Use the WEP online calculator and WEP reduction chart.

Social Security What Is The Windfall Elimination Provision How Does It Affect Your Benefits

You also need to enter the monthly amount of your pension that was based on work not covered by Social Security.

. 1 Estimates past earnings from current with a national average wage index modified by a relative growth factor. How the WEP is Calculated. Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected.

Estimating the Amount of the Government Pension Offset and Windfall Elimination Provision. The Windfall Elimination Provision may apply if you receive both a non-covered pension and Social Security retirement benefits. You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement.

This tool also accounts for the windfall elimination provision and government pension offset. The Windfall Elimination Provision does not apply if. For more information check out our Windfall Elimination Provision web page.

This will affect you if you get a pension from an employer who didnt withhold Social Security tax from your earnings. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. Compare mortgage terms.

Past earnings can be adjusted by changing the. If you are CSRS Offset social security benefits may be subject to CSRS Offset at age 62. But theres a bill in Congress which has strong backing that could eliminate both the windfall elimination provision and the government.

When Social Security benefits are calculated the SSA inflates your historical earnings takes your highest 35 years of earnings and divides by 420 the number of months in 35 years. This calculator costs 40 for a yearly household license. Estimate if you are eligible for a pension based on work that was not covered by Social Security.

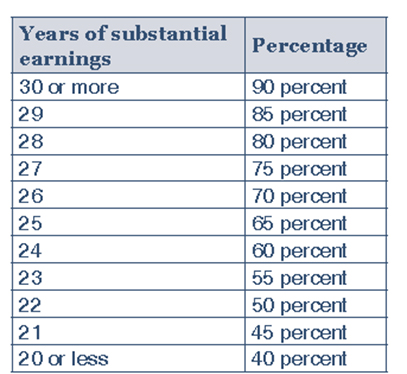

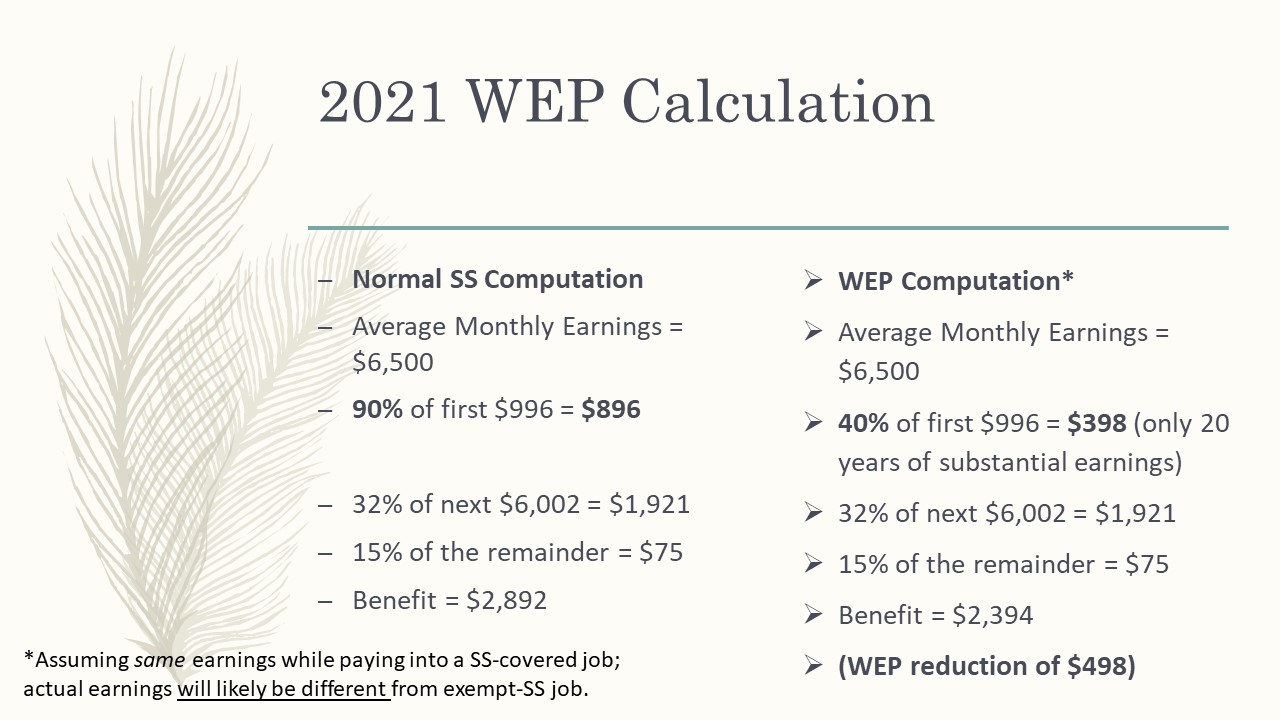

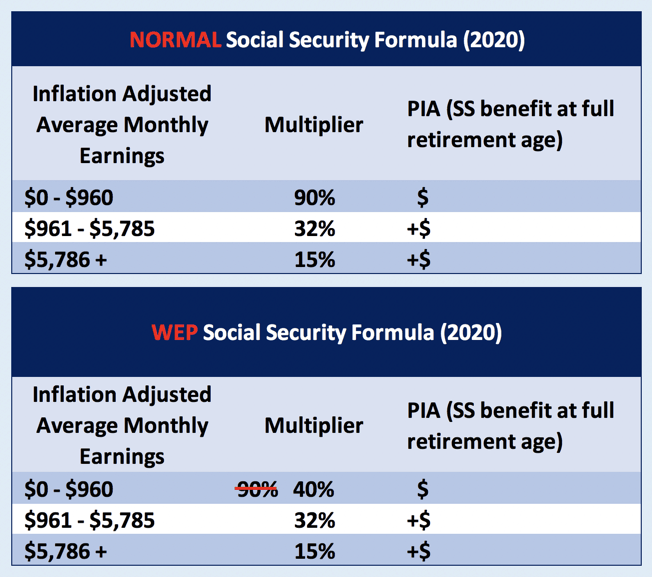

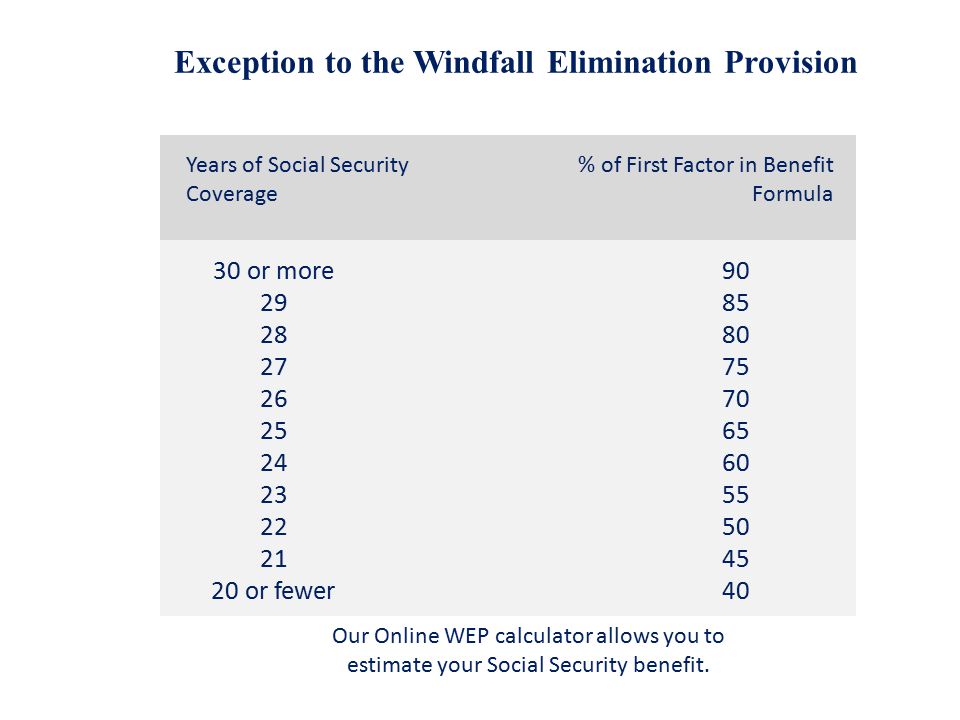

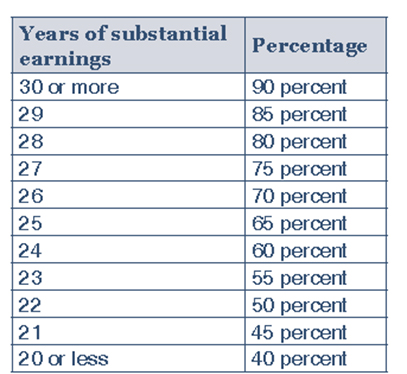

Or You have 30 or more years of substantial earnings under Social Security. The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were. The WEP is simply an alternate formula for calculating Social Security benefits for those who have a pension from a job where no Social Security taxes were paid.

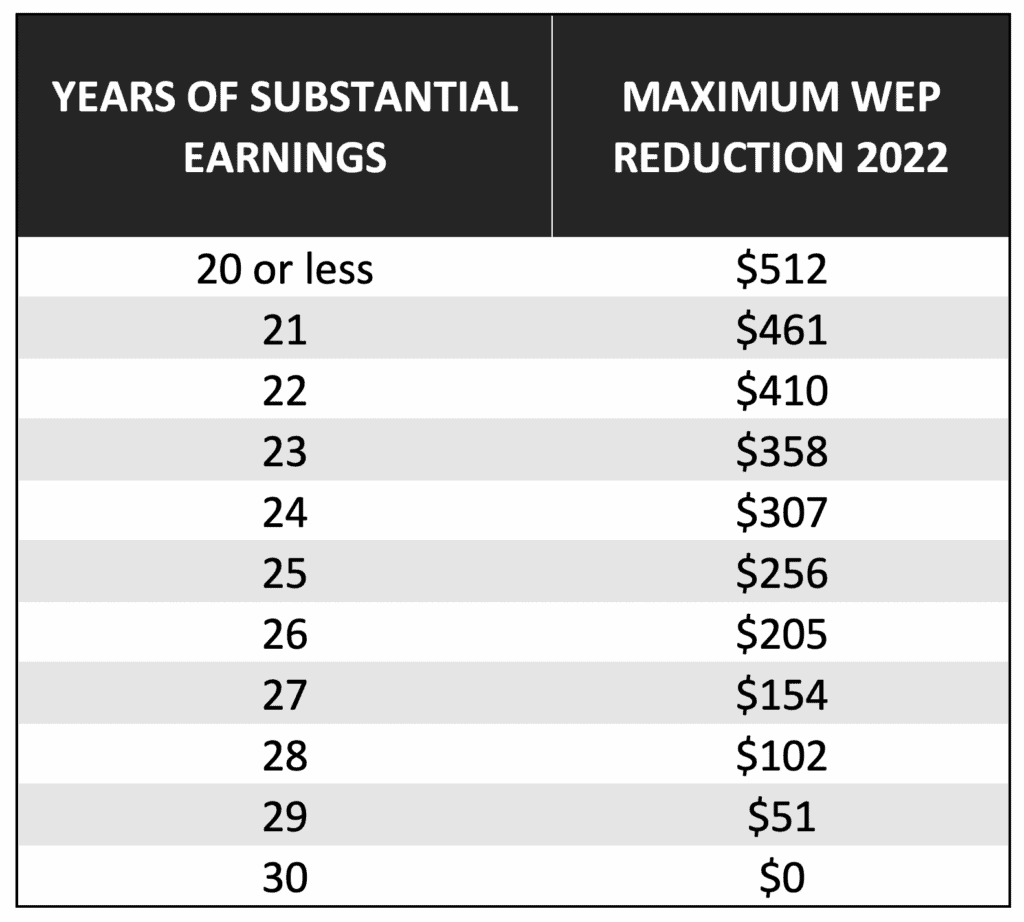

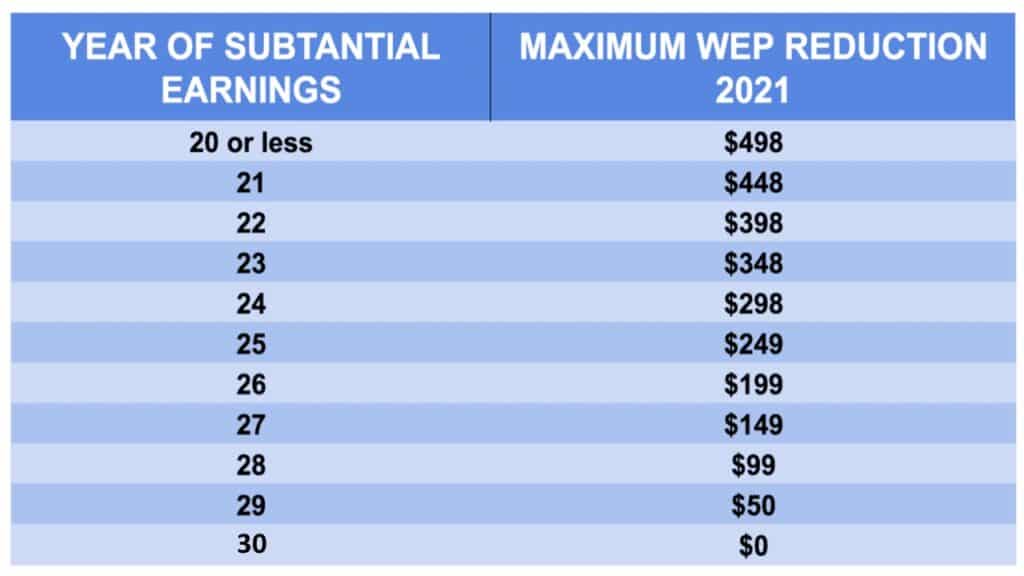

What is the maximum WEP reduction if I am currently due to get 1040 a month in retirement. You developed a qualifying disability after 1985. The estimate does not include WEP reduction.

The WEP may apply if you receive both a pension and Social Security benefits. Continue reading The post Congressional Bill May Soon End Windfall Elimination appeared. Windfall Elimination Program WEP.

NARFEs national legislative program is advanced in Congress by a team of registered lobbyists backed by an informed network of grassroots activists in every state and congressional district as well as a member-supported Political Action Committee PAC. A aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam. Our Retirement Earnings Test Calculator can help you find out how much your benefits may be reduced if you are working and.

Use the Social Security Benefit calculator to calculate this input. The Windfall Elimination Provision can apply if one of the following is true. The windfall elimination provision and government pension offset both can reduce the Social Security payments a public employee collects.

The WEP calculator and GPO calculator at Social Securitys website can help you estimate how much these rules will cut into. Worcester Regional Retirement System 23 Midstate Drive Suite 106 Midstate Office Park Auburn MA 01501 Telephone. Resist the temptation to splurge and use this windfall to pay down your existing balance.

For more information see the Social Security Administrations WEP Benefit Calculator. Estimate of your benefits in todays dollars or future dollars when you input your date of birth and this years earnings. If you have a non-covered pension from work where you didnt pay SS taxes and a Social Security benefit from other work where you did pay SS taxes you need to understand the Windfall Elimination Provision.

I have 12 years of service contributing to social security. It includes a link to an online WEP calculator that can tell you how your Social Security benefits may. Government Pension Offset Use the GPO online calculator.

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount. Apart from saving make use of any large funds you get throughout the year. If the latter applies you must first have become eligible for a monthly pension based on work where you didnt pay Social Security taxes after 1985.

The WEP may reduce your Social Security benefit but it will not eliminate it. WEP Windfall Elimination Provision Can cut an amount up to to half the value of your pension from the Social Security you have earned in other work. Windfall Elimination Provision Mechanics.

This calculator enables you to accurately calculate the tax savings of the mortgage. The WEP can reduce your benefit payment by as much as half the amount of your pension. Whether you use work bonuses or cash gifts from your loved ones it can help you make extra payments.

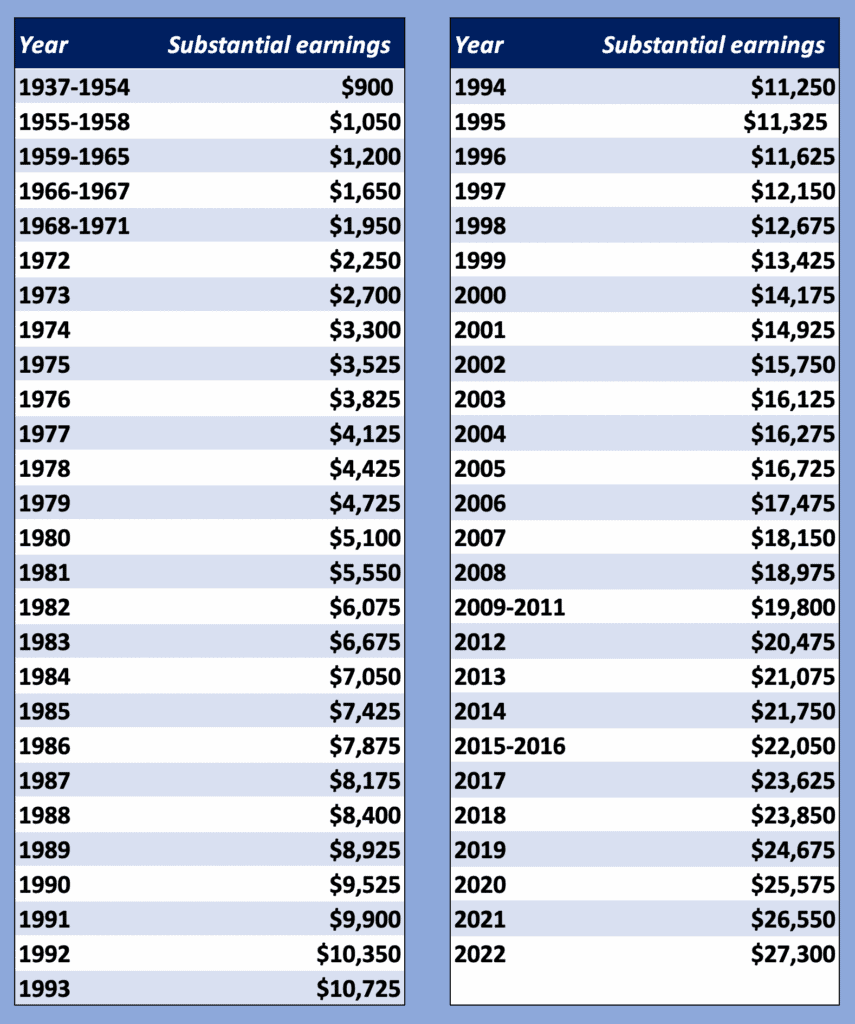

Pay Down Balances with a Windfall. Youll find a table that lists the amount of substantial earnings for each year at the bottom of the second page of the Windfall Elimination Provision fact sheet. I live in Texas which is a Windfall Elimination Provision state.

You were eligible to retire before January 1 1986. Windfall Elimination Provision WEP Calculator. If in the course of your career you worked for both 1 at least one employer that did withhold Social Security taxes and 2 at least one employer that didnt withhold Social Security taxes and that offers a pension the windfall elimination provision WEP may come into play.

Windfall Elimination Provision WEP no WEP Version available no yes Notes. A Social Security online calculator shows you the percentage of your spouses benefits you will get based on your age when you apply. You reached age 62 after 1985.

You were first employed by the government after December 31 1983. State employees for example may find this helpful.

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

Social Security Windfall Elimination Provision Government Pension Offset Meld Financial

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Firefighter Pensions And Social Security How To Reduce Or Eliminate The Impact Of The Windfall Elimination Provision Wep Social Security Intelligence

The Windfall Elimination Provision Wep In Social Security Comparing Current Law With Proposed Proportional Formulas Everycrsreport Com

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security S Windfall Elimination Provision

Remember The Fastest Way To Verify Social Security And Ssi Benefits My Social Security Provides An Online Benefit Verification Letter Immediately Socialsecurity Gov Myaccount Ppt Download

Social Security And The Windfall Elimination Provision

What Is The Wep And Does It Affect Retirement Income

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

Social Security Sers

How The Social Security Windfall Elimination Provision Wep Impacts Pension Payments Carmichael Hill